A Smarter Way to Grow Super

When it comes to superannuation, most Australians focus on growing their balance — but few stop to consider how that money can keep working for them once they retire. A new type of super solution is changing the game by helping people build more effective long-term income strategies that support both growth and reduce running out of money in retirement.

The best part? It’s not just for retirees — it’s designed to benefit anyone who wants to make the most of their super throughout life.

What is it?

It is an innovative approach to superannuation and retirement income. It helps Australians grow their super during their working years and then convert it into an income stream when they retire.

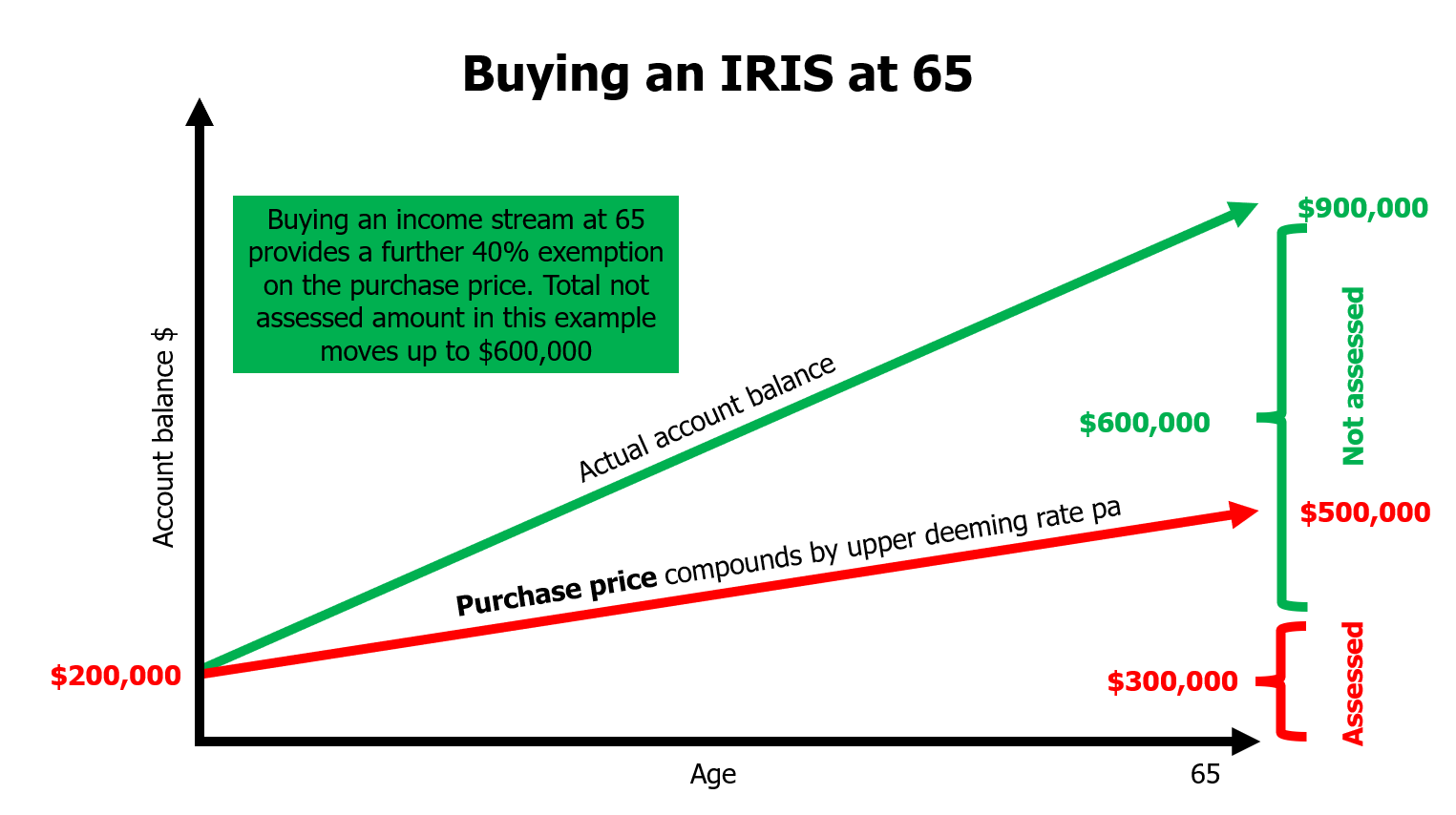

It’s designed to complement traditional super and pension products — offering more flexibility, potential Centrelink advantages, and a focus on making retirement income last longer.

How it works

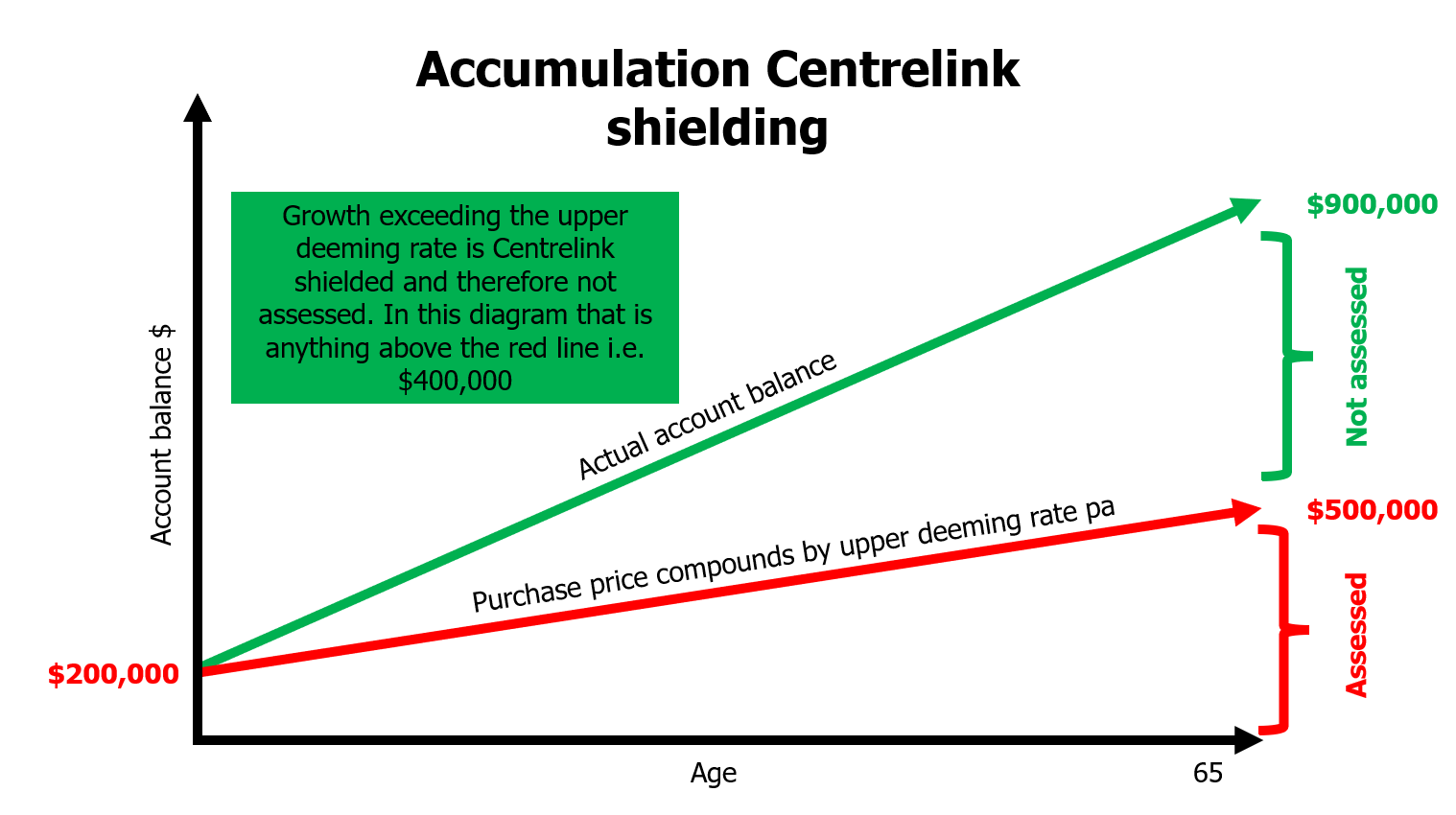

During the saving (accumulation) phase, your super operates much like a standard account — but with an added benefit. Investment earnings are deemed by Centrelink at their upper deeming rate of 2.75%, even if your fund performs much better (for example, 8%).

This means that, for Centrelink purposes, your balance could be assessed more favourably. In some cases, this may lead to higher Age Pension entitlements down the track, helping you stretch your income further in retirement.

Why starting early matters

The real strength lies in time and compounding. The earlier you start, the greater the long-term benefit.

By entering during your working years, you can build up the underlying advantages — such as the Centrelink deeming treatment and potential for an improved retirement lifestyle.

In short, it rewards people who plan ahead.

Key benefits of a Retirement Boost strategy

- Potential for higher retirement income — giving you more freedom and choice later in life

- Favourable Centrelink treatment — with earnings deemed at 2.75% regardless of actual performance

- Continued investment choice and flexibility — across a familiar super and pension platform

- Access to contributions — including downsizer contributions, even while income payments are deferred

Who can benefit?

While it’s an excellent option for those approaching retirement, anyone who’s serious about building a stronger financial future can benefit from this approach. Whether you’re in your 20s, 30s or already retired, the combination of compounding growth, favourable Centrelink treatment can make a meaningful difference over time.

Final thoughts

This represents a fresh way of thinking about superannuation — one that focuses not just on building wealth, but on turning that wealth into a comfortable retirement.

If you’d like to explore how this approach could enhance your retirement strategy, or see how it compares to your current setup, reach out to Elevate Financial Planning for a personalised discussion.

For personalised financial services and advice, speak with your Financial Advisor today at Elevate Financial Planning

- Arlan Davine